Understanding Tax and Spend Power

Popular In Constitution

Purpose Of Lifetime Appointment And Pros And Cons Enumerated Powers Bicameral Legislature Background Article 3 Of The Constitution We The People 1st Amendment Who Wrote The Constitution Judicial Review Equal Protection Clause 5th Amendment 10th Amendment Three Fifths Compromise

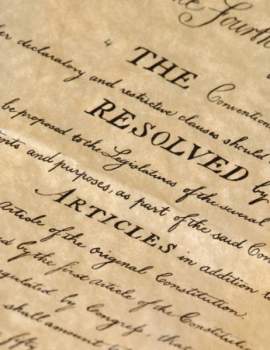

Located within Article I, Section 8 of the United States Constitution, the "Taxing and Spending Clause" represents an aspect by which the Federal Government possesses the authority to impose taxation upon the general public. Subsequent parts of this Clause include that of the "General Welfare Clause" as well as the "Uniformity Clause." As set forth, this Clause maintains the Government’s authority to both tax and spend Government funds.

In terms of tax policy, one of its most important purposes is for the Government to increase revenue so that the Government may operate adequately in support of its citizens. In addition, however, there exist other considerations that Congress must take into account. These include regulatory and prohibitive taxation, as well as the existence of tariffs.

Regulatory tax policy exists to put forth limitations upon commerce, while prohibitive taxation functions to actually decrease or do away with commerce altogether. Tariffs, then, operate to protect domestic markets from foreign take-overs.

One of the last Supreme Court cases that would place limitations upon Congress' powers of taxation and spending includes United States v. Butler. The Court ruled that taxes imposed due to the Agricultural Adjustment Act were deemed unconstitutional with regard to State regulations, and thus, violated the Tenth Amendment. Despite this seemingly overwhelming power that the Government possesses in terms of tax policy, there also exist important limitations. These include stipulations concerning apportionment of taxes as well as those attached to exports and to the general welfare of the public.

When concerning the Government's power to spend, we may approach it as the spending of what is garnered by taxation. The purpose of such spending would, then, be for the express purpose of furthering achievement at specified Federal Government goals. An example of a Supreme Court case that rewarded good and appropriate local government conduct was that of South Dakota v. Dole.

The Court ruled that it was Constitutional for the Federal requirement for states to raise their legal drinking age to that of 21 years of age. In doing so, it was deemed fair to keep highway funds from them until they had changed their statutes.

The area of most contention within that of the powers to tax and spend arises from the General Welfare Clause. Within this Clause, some concerns included whether or not such a clause to tax and spend had imposed free spending power versus restricted taxation. Also, there was much contention over what the Clause actually entailed in terms of its genuine definition.

NEXT: What Is The Criminal Law and Procedure